What Do You Actually Net When You Sell Your Home? A Treasure Valley Breakdown

When you imagine selling your home, you probably think about the sale price first.

"If I sell my house for $700,000, that's what I'll walk away with, right?"

Not quite.

The reality is that the sale price and your net proceeds are two very different numbers...and most sellers are surprised by how much of the sale price goes toward closing costs, commissions, and other fees.

The good news is that partnering with a great real estate agent/team can increase the demand for your home which can raise the market value vs selling by yourself.

In this article, I'll break down exactly what you can expect to net when you sell your home in the Treasure Valley, what costs to anticipate, and how to maximize what you actually take home.

The Difference Between Sale Price and Net Proceeds

Sale price = what the buyer pays for your home

Net proceeds = what you walk away with after all costs and payoffs

Here's a simplified example:

- Sale price: $700,000

- Remaining mortgage balance: $350,000

- Real estate commissions: $42,000 (6% in this example)

- Closing costs: $7,000

- Repairs/concessions: $3,000

Net proceeds: $700,000 - $350,000 - $42,000 - $7,000 - $3,000 = $298,000

In this scenario, you'd net roughly 43% of the sale price.

The exact percentage varies based on how much you owe on your mortgage, your commission structure, and other factors...but the point is clear: you don't keep the full sale price.

What Costs Should You Expect?

Let's break down the typical expenses involved in selling a home in Idaho.

1. Real estate commissions

This is usually the largest cost.

Traditionally, the total commission is around 5–6% of the sale price, split between the listing agent and the buyer's agent.

On a $700,000 home:

- 6% commission = $42,000

- 5% commission = $35,000

Some sellers try to save money by listing as "for sale by owner" (FSBO) or using a discount brokerage. But here's the catch: commission structure affects buyer interest.

Most buyers work with agents, and those agents are compensated from the total commission. If you cut the commission too aggressively, some agents may steer their buyers away from your listing which can limit your exposure and potentially lowering your sale price.

Also... real estate commissions are not a set percentage and can differ from one company to another.

Bottom line: The right agent doesn't cost you money—they make you money through better pricing, marketing, and negotiation.

2. Title and escrow fees

In Idaho, sellers typically pay for:

- Owner's title insurance policy

- Escrow or closing fees (often split with the buyer)

These costs vary but generally run $1,500–$3,000 depending on the sale price and title company.

3. Closing costs and prorations

You'll also pay:

- Prorated property taxes (your share up to closing day)

- HOA fees (if applicable), prorated to closing

- Any outstanding liens or assessments

Expect another $1,000–$3,000 depending on your situation.

4. Repairs, concessions, or credits

During the inspection period, buyers often request repairs or ask for credits to handle issues themselves.

Common requests include:

- HVAC or water heater repairs

- Roof issues

- Plumbing or electrical updates

- Cosmetic items like paint or flooring

Even in a strong market, it's common to negotiate $2,000–$10,000 in repairs or credits.

This all depends on the condition of your house and what the buyer asks after an inspection. Many of our owners end up paying $0 after negotiations, but I just wanted to help you understand some of these potential expenses.

5. Mortgage payoff

If you still owe money on your home, the remaining loan balance will be paid off at closing.

This is often the largest single deduction from your sale price—but it's also the reason you're building equity in the first place.

6. Miscellaneous costs

Depending on your situation, you might also pay for:

- Home warranty for the buyer ($400–$600)

- Final utility bills

- Moving costs (not technically a closing cost, but a real expense)

- Staging or pre-listing repairs to maximize sale price

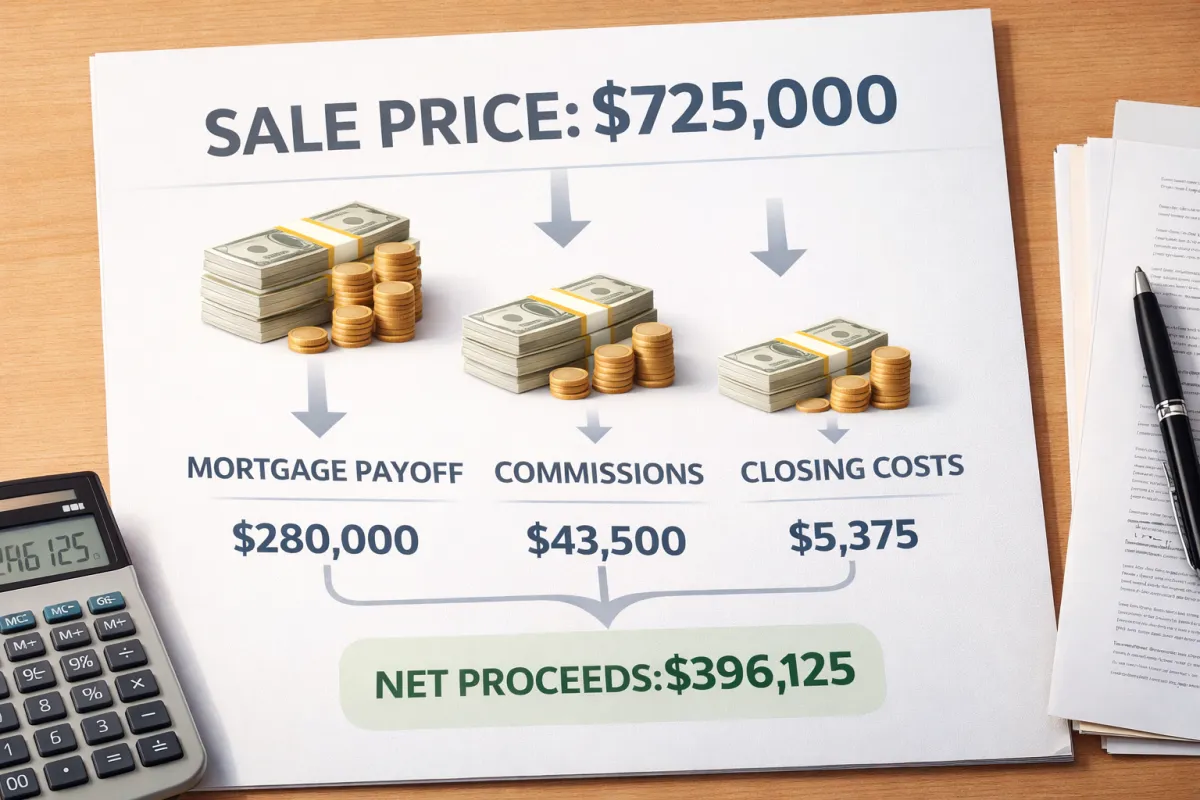

Sample Net Proceeds Breakdown

Let's walk through a real-world example for a home in Meridian:

| Item | Amount |

|------|--------|

| Sale price | $725,000 |

| Mortgage payoff | -$280,000 |

| Real estate commission (5.5%) | -$39,875 |

| Title and escrow fees | -$2,200 |

| Property tax proration | -$1,800 |

| Inspection repairs/credits | -$4,500 |

| Home warranty | -$500 |

| Total deductions | -$328,875 |

| Net proceeds | $396,125 |

In this case, the seller nets approximately 54.6% of the sale price.

That's still a substantial amount...but it's important to know the real number before you list, so you can plan accordingly. You should get a estimated net sheet before you even list your house.

How to Maximize Your Net Proceeds

You can't avoid all closing costs, but you can take steps to keep more money in your pocket.

1. Price your home strategically

The biggest factor in your net proceeds is your final sale price.

Pricing too high and sitting on the market leads to price reductions and weaker offers. Pricing right from the start can generate competition and drive your sale price up.

A $20,000 higher sale price puts $20,000 in your pocket (minus the marginal commission increase). That's far more impactful than nickel-and-diming on fees.

2. Prepare your home to sell

Homes that show well sell for more money.

Small investments in:

- Deep cleaning

- Decluttering

- Fresh paint

- Landscaping and curb appeal

- Minor repairs

...can yield a significant return by increasing buyer interest and reducing negotiation leverage during inspections.

3. Work with a skilled negotiator

An experienced agent will:

- Negotiate inspection requests to minimize repair costs

- Protect you from unreasonable buyer demands

- Structure the deal to maximize your net proceeds

The difference between a mediocre agent and a great one can easily be $10,000–$30,000 in your pocket.

4. Understand your costs upfront

No surprises. Get a net proceeds estimate before you list so you know exactly what to expect and can plan your next move.

Why Most Sellers Don't Know Their Net Proceeds Until It's Too Late

Here's a frustrating reality: many sellers don't see a detailed breakdown until just before closing—when it's too late to change strategy.

By that point:

- The price is locked in

- Repairs have been negotiated

- The deal is done

That's why it's critical to understand your numbers before you list.

A good agent will provide you with an estimated net proceeds sheet before you sign the listing agreement. This allows you to:

- Set realistic expectations

- Plan your next purchase or move

- Make informed decisions about pricing and repairs

How IdaListings Provides Clarity and Transparency

At IdaListings, we believe you deserve to know the real numbers upfront...not at the closing table.

Here's what we provide:

✅ A detailed net proceeds estimate

We'll show you exactly what you can expect to walk away with based on current market conditions, typical closing costs, and your specific situation.

✅ Strategic pricing guidance

We'll help you price your home to maximize your sale price—which is the #1 driver of your net proceeds.

✅ Skilled negotiation

We protect your interests during inspections, appraisals, and closing to minimize unnecessary costs and keep more money in your pocket.

✅ No hidden fees or surprises

We're upfront about costs, timelines, and expectations. What we tell you is what you'll get.

Get Your Free Net Proceeds Estimate

Stop guessing. Know exactly what you'll net when you sell your Treasure Valley home.

Request a free, personalized home value analysis that includes:

- Estimated sale price based on current market data

- Breakdown of expected closing costs

- Net proceeds estimate so you can plan your next move

Get Your Free Home Value & Net Proceeds Report at https://IdaListings.com/value

No pressure. No obligation. Just honest numbers and expert guidance.

About IdaListings

IdaListings specializes in helping Treasure Valley homeowners sell their homes with clarity, confidence, and maximum profitability. Led by Ben Janke, Associate Broker and licensed Realtor since 2005, we provide transparent guidance and proven results.